Pkf Advisory Services for Dummies

Table of ContentsSome Known Details About Pkf Advisory Services Not known Details About Pkf Advisory Services The smart Trick of Pkf Advisory Services That Nobody is Talking AboutThe Pkf Advisory Services PDFsExcitement About Pkf Advisory ServicesExcitement About Pkf Advisory Services

When it comes time for an assessment, it is critical for local business owner to be clear on: What is being valued or appraised Why the valuation/appraisal is taking location What sort of appraisal specialist need to be doing the work If owners are not clear about this they will wind up with an ineffective report, wasting valuable time, power, and money.The objective of the valuation always notifies the approach, and as a result the skill established you'll want the assessment company to have. Some evaluation analysts do it all while others do not meaning, some analysts provide all-inclusive assessments, while others specialize in a certain niche. Company owner should be explicit about what they are seeking to get out of the appraisal.

Lots of will not, or will certainly charge extra fees to do so. Some assessment experts focus on particular appraisals that finish up in lawsuits. Below is a failure of the numerous types of valuation services you may encounter and that they are best matched for. During a commercial genuine estate appraisal, experts will certainly value actual property assets such as land and buildings.

Excitement About Pkf Advisory Services

While it is essential to the organization, the company would have the ability to take place without it. Staff members could work from home and the proprietor can find a new workplace with a little bit of research study. Compare this to, state, a resort, where 100% of the company's income depends upon the structure remaining operational.

Some Ideas on Pkf Advisory Services You Should Know

There are professionals for this kind of evaluation. Unlike other evaluations and evaluations, which examine concrete assets, a copyright (IP) assessment thinks about intangible properties. These can be specifically beneficial to help company owners establish the reasonable value of their company and IP assets. There are specialists that use these sorts of company valuation try this web-site solutions.

The record is normally provided by the valuation expert, permitting the proprietor to ask questions and obtain clarification. Once again, the secret is to obtain excellent details based on the purpose of the valuation, and just how the owner (and others) might require to use it.

Facts About Pkf Advisory Services Uncovered

Proprietors have to do their due persistance and choose an expert that can offer good details based on the function of the appraisal. Monetary market participants make use of assessment to identify the cost they are willing to pay or get to effect a service sale. In its easiest form, service valuation can be seen as a procedure to establish the worth of a firm based on its possessions, incomes, market setting, and future incomes potential.

Relevance of Company Evaluation for Proprietors, Financiers, and Stakeholders For entrepreneur, recognizing the worth of their service is important for making informed decisions regarding its sale, development, or succession planning. Capitalists utilize assessments to assess the try this site prospective profitability of spending in a company, assisting them determine where to designate resources for the very best roi.

This resource will certainly equip you with an essential understanding of business assessment, its importance, and in-depth details to think about if you require to work with an appraisal specialist. Recognizing the subtleties of different appraisal metrics is vital. Below's a failure of 4 core ideas: reasonable market worth, investment worth, inherent worth, and book value, together with a conversation on importance.

Fascination About Pkf Advisory Services

The fair market worth common uses to mostly all government and state tax issues and separation situations in a number of states. Interpretations and applications might vary between jurisdictions. This standard of worth describes the value of a possession or service to a particular buyer or vendor. Contrary to the "theoretical" buyer or vendor presumption utilized under reasonable market value, the financial investment value standard takes into consideration the owner's or customer's expertise, abilities, assumption of dangers and making possible, and other factors.

Subsequently, this criterion of worth is typically used when valuing a business being considered for potential acquisition. Inherent worth is the value intrinsic in the home itself. While financial investment value is extra reliant upon features sticking to a certain purchaser or owner, intrinsic value represents an estimate of value based upon the perceived attributes of the financial investment itself.

(It needs to be kept in mind that Virginia situation legislation recommendations "innate value" as the applicable requirement for divorce. The interpretation of the term in the case law differs from that offered here). Fair value is the standard of worth for sure sorts of shareholder lawsuits, such as shareholder oppression and dissenting civil liberties instances.

As necessary, the worth of a certain possession interest under this requirement of value can be considered as the value of the professional rata interest in the total worth of a business's equity. Nevertheless, its interpretation can differ from state to state, so it is crucial to understand the laws and pertinent situation law for the state.

An Unbiased View of Pkf Advisory Services

A business evaluation gives a precise quote of business's well worth, helping to establish a fair rate that reflects the business's value. It guarantees that the proprietor does not underestimate the organization or set an unrealistically high price that deters prospective purchasers (PKF Advisory Services). Businesses seeking to increase funding through equity financing require to recognize their business's worth to identify just how much equity they have to quit in exchange for investment

Jaleel White Then & Now!

Jaleel White Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Marques Houston Then & Now!

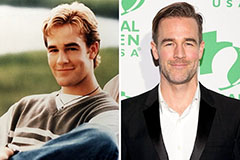

Marques Houston Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!